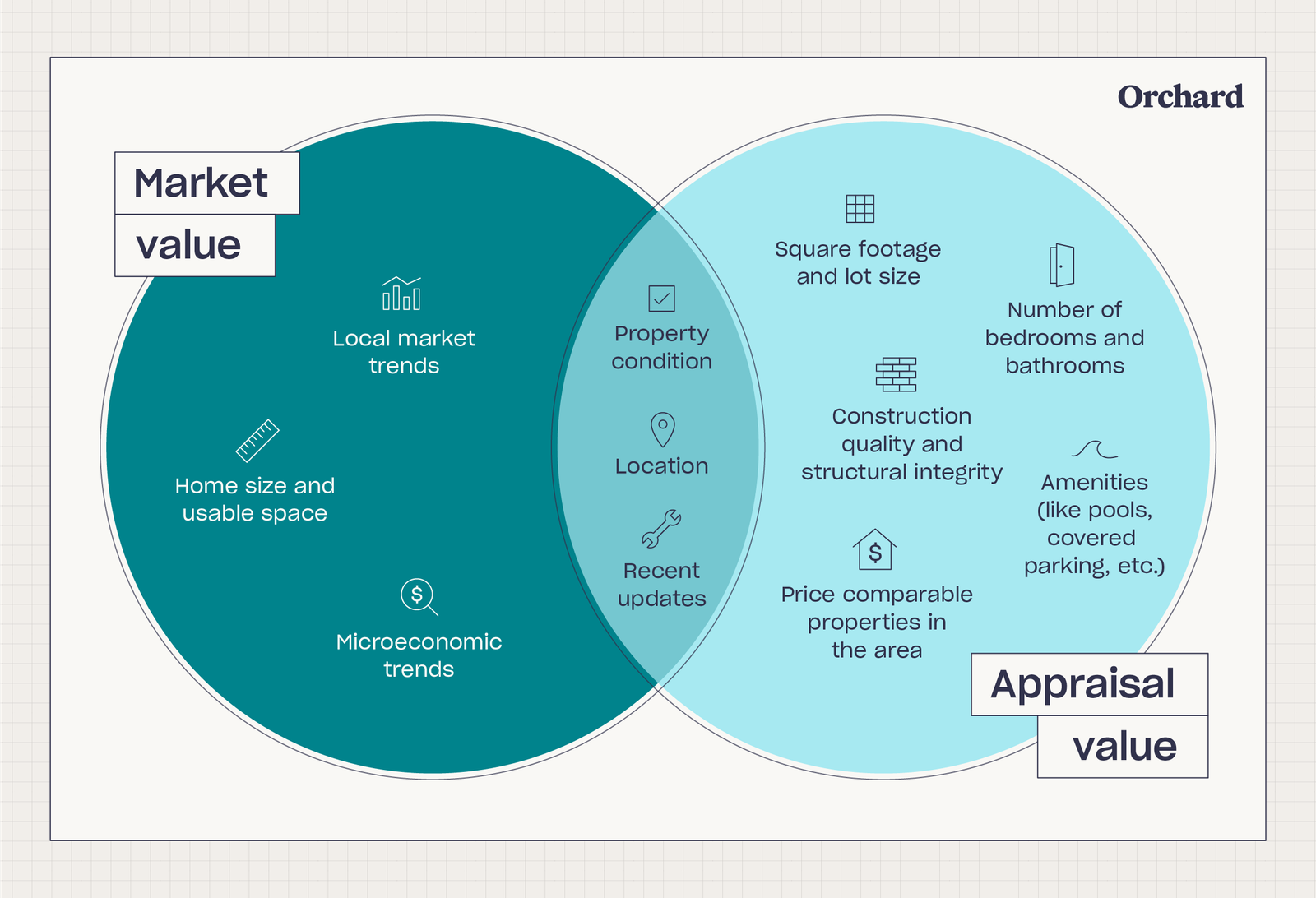

If you’ve ever tried to buy, sell, or invest in property, you’ve likely come across the terms market value and appraised value. While they might seem interchangeable at first glance, these are two distinct concepts—each critical in its own way. Understanding the difference can help you make smarter property decisions, negotiate better deals, and confidently plan your investments.

Let’s explore what each term means, why the distinction matters, and how property valuation works in both Australia and the United States.

Market Value vs. Appraised Value: What’s the Difference?

Market Value: A Moving Target

Market value refers to the current price a property could fetch in a competitive, open market. It’s shaped by factors such as:

- Recent sales of comparable properties

- Local demand and supply

- Broader economic trends

- Buyer sentiment

- Infrastructure or urban development

- Location and timing

Unlike appraised value, market value is dynamic. It can fluctuate quickly based on changes in the economy, interest rates, or even seasonal demand. For sellers and investors, this is the number that reflects how much someone is likely to pay for a property today—not six months ago, and not six months from now.

Appraised Value: A Professional Snapshot

On the other hand, appraised value is determined by a certified property valuer or appraiser. This valuation involves a professional inspection of:

- The property’s size, layout, and condition

- Comparable recent sales in the area

- Any renovations or upgrades

- Land value

- Zoning or legal considerations

The result is a more structured, objective assessment—useful for lenders, insurance, and legal purposes. However, appraised values can sometimes lag behind fast-moving market trends because they are based on recent data, not real-time demand.

Why the Distinction Matters

Understanding the difference between market and appraised values is important whether you’re:

- Buying – You might be willing to pay more than the appraised value if demand is high.

- Selling – Knowing market value helps set a realistic asking price.

- Refinancing – Lenders base decisions on appraised values.

- Investing – Market value helps evaluate timing, while appraisals support financing.

In short, market value reflects what buyers are currently paying, while appraised value provides an expert opinion grounded in the recent past.

How to Calculate Market Value in Australia

Australia’s property market is diverse and region-specific. Each suburb, town, or city presents unique pricing trends and buyer behaviour. Here’s how to get a true sense of a property’s market value:

Step 1: Understand Local Conditions

Each region in Australia—from bustling Sydney to the more relaxed pace of Hobart—has its own economic rhythm. Local market value depends heavily on:

- Employment rates

- Population growth

- Proximity to transport or infrastructure

- Recent government policies

- Supply and demand

For example, a new rail line can dramatically lift values in suburbs previously considered “too far out.” Conversely, areas with oversupply can experience stagnant or falling prices.

Step 2: Choose the Right Valuation Approach

There are three commonly used valuation methods in Australia:

- Comparable Sales Method:

This is the most frequently used method. You look at recent sales of similar properties (in terms of size, type, and location) and use those figures to estimate your property’s market value. - Income Method:

Suitable for investment properties, this method calculates value based on the rental income a property generates, factoring in expenses and potential return on investment (ROI). - Cost Method:

This method evaluates the cost of building a similar property from scratch today, minus any depreciation. It’s especially useful for unique or new constructions where comparables are limited.

Step 3: Get Professional Guidance

While online tools and research give a good starting point, a licensed property valuer can provide detailed, location-specific insights. Their formal assessment is recognised by banks, lenders, and legal authorities.

Their knowledge of market nuances—like zoning changes or flood risks—adds depth to your decision-making process that data alone can’t provide.

Property Valuation in the United States

The U.S. property market operates similarly in many respects, but with a few unique methods and metrics.

Step 1: Know the Cap Rate

For U.S. real estate investors, the capitalisation rate (cap rate) is a key indicator of a property’s profitability. It’s calculated by dividing a property’s net operating income by its market value.

A higher cap rate generally suggests higher risk, but also greater potential return—especially in growing or up-and-coming markets.

Step 2: Alternative Valuation Methods

- Replacement Cost Method: This approach values a property based on how much it would cost to build an identical one today. It includes land cost, construction, and depreciation.

- After Repair Value (ARV): Widely used by property flippers or renovators, ARV estimates a property’s market value after it has been improved or renovated.

These methods are often applied in dynamic markets where properties are frequently upgraded or used for investment purposes.

Step 3: Historical Price Analysis

Studying a property’s price history can reveal important trends. Did values dip during a past recession? Have prices surged in the last five years? This context can help predict future value growth or volatility.

Public records, online platforms, and real estate databases provide a wealth of historical price information in most U.S. states.

Step 4: Use Digital Tools Wisely

AI-powered valuation tools can offer instant estimates by aggregating market data and past sales. While convenient, these should be considered a starting point rather than a final decision-maker.

Step 5: Hire a Certified Appraiser

For legal or financial decisions, nothing beats a formal appraisal. A certified appraiser will consider local market trends, recent sales, and the condition of the property for a reliable and defendable value.

Why Data-Driven Valuation Matters

Whether you’re a homeowner, buyer, or developer, your decisions should be backed by accurate, up-to-date data. This gives you a clearer picture of real estate trends, reduces risk, and ensures smarter strategies.

Understanding market and appraised values empowers you to:

- Set appropriate price expectations

- Negotiate effectively

- Make sound investment choices

- Avoid overpaying or undervaluing assets

Final Thoughts

Property valuation isn’t just about numbers—it’s about making informed decisions with confidence. Whether you’re eyeing a unit in Brisbane, a villa in Los Angeles, or a commercial block in Melbourne, knowing both the market value and appraised value gives you a powerful edge.

In a constantly changing market, the smartest investors and homebuyers aren’t just relying on luck—they’re relying on knowledge, data, and expert insight.