Fiscal policy is one of the most powerful tools a government can use to influence a nation’s economy. In the United States, fiscal policies play a critical role in shaping economic growth, managing inflation, funding public services, and responding to financial crises. These policies, largely centered on taxation and government spending, affect the daily lives of Americans in more ways than most realize.

Whether you’re filling out your tax return, driving on a newly built highway, attending a public school, or applying for unemployment benefits, you’re experiencing the real-world impact of fiscal decisions made at the highest levels of government.

In this article, we’ll break down what U.S. fiscal policy is, how it works, who controls it, and how it affects the American economy.

What Is Fiscal Policy?

Fiscal policy refers to the government’s use of spending and taxation to influence the economy. It’s distinct from monetary policy, which is managed by the Federal Reserve and deals with interest rates and money supply. Fiscal policy is a legislative and executive tool — shaped by Congress and the President — and is carried out through the federal budget.

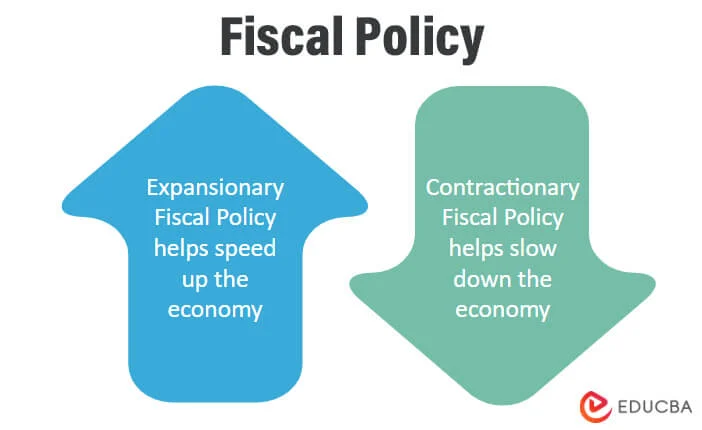

There are two primary types of fiscal policy:

- Expansionary Fiscal Policy: Increases government spending or cuts taxes to stimulate the economy. This is usually applied during periods of economic slowdown or recession.

- Contractionary Fiscal Policy: Reduces government spending or increases taxes to cool down an overheated economy, usually when inflation is high.

Key Components of U.S. Fiscal Policy

1. Government Spending

The federal government spends trillions of dollars every year. This spending is categorized into two main types:

- Mandatory Spending: This includes programs like Social Security, Medicare, and Medicaid. These are entitlement programs, meaning funding is automatic and does not require annual approval from Congress.

- Discretionary Spending: This includes spending on defense, education, transportation, and other programs that Congress must approve each year in the federal budget.

Government spending can stimulate demand in the economy by creating jobs, funding infrastructure, and supporting income through welfare programs.

2. Taxation

Taxes are the government’s main source of revenue. The U.S. has a progressive income tax system, meaning higher earners pay a higher percentage of their income in taxes.

In addition to federal income taxes, the government collects:

- Corporate taxes

- Payroll taxes (for Social Security and Medicare)

- Capital gains taxes

- Excise taxes (on gasoline, tobacco, etc.)

Changes in tax policy can encourage or discourage certain behaviors. For example, tax cuts may boost consumer spending and investment, while tax increases might slow economic activity but help reduce budget deficits.

Who Controls Fiscal Policy?

Fiscal policy in the U.S. is a joint effort between two branches of government:

- Congress: Holds the “power of the purse.” It passes legislation that determines tax rates and authorizes government spending.

- The President: Proposes a federal budget each year and works with Congress to shape and approve it.

Both parties in the U.S. often have differing philosophies on fiscal matters. Democrats may lean toward increased spending on social programs and progressive taxation, while Republicans may prioritize tax cuts and reduced government involvement.

Fiscal Policy in Action: A Look at Recent History

2008 Financial Crisis

In response to the Great Recession, the U.S. government implemented massive stimulus packages, including the Emergency Economic Stabilization Act and the American Recovery and Reinvestment Act. These measures involved large-scale government spending and tax relief to revive the economy and prevent a total collapse of financial institutions.

COVID-19 Pandemic (2020–2021)

Another dramatic example of expansionary fiscal policy was during the COVID-19 crisis. The U.S. government passed multiple relief packages totaling over $5 trillion, including stimulus checks, enhanced unemployment benefits, and business loans. These efforts were aimed at stabilizing households and businesses during the economic shutdown.

While these policies helped avoid a deeper recession, they also contributed to a rising national debt and inflation, sparking debate about long-term fiscal responsibility.

The Federal Budget and the National Debt

Every year, the government must balance what it spends with what it earns through taxes. When spending exceeds revenue, the U.S. runs a budget deficit. Over time, these deficits add up to the national debt — which now exceeds $34 trillion.

While some economists argue that debt can be manageable if used for productive investment (like infrastructure or education), others warn that high debt levels can crowd out private investment, increase interest costs, and lead to higher taxes in the future.

Fiscal Policy and Inflation

Fiscal policy can affect inflation both positively and negatively. When the government spends aggressively or cuts taxes during an economic boom, it can lead to higher inflation due to increased demand. Conversely, reducing spending or increasing taxes can help tame inflation but may slow growth or cause job losses.

In recent years, high inflation in the U.S. has sparked debates over whether the government should scale back fiscal stimulus and whether future budgets should include more targeted, responsible spending.

Challenges of U.S. Fiscal Policy

Crafting sound fiscal policy is a complex task, and the U.S. faces several long-term challenges:

- Entitlement Spending: Programs like Social Security and Medicare are projected to become more expensive as the population ages.

- Partisan Gridlock: Political divisions often make it difficult to pass budgets or agree on tax reforms.

- Debt Ceiling Debates: Disagreements over raising the debt limit can lead to government shutdowns and financial instability.

- Global Uncertainty: Wars, pandemics, and global market shifts can quickly change the direction and needs of fiscal policy.

Future Outlook

As we look ahead, U.S. fiscal policy will likely focus on:

- Modernizing infrastructure

- Investing in green energy and climate resilience

- Strengthening social safety nets

- Addressing student loan debt

- Balancing growth with debt reduction

Policymakers will need to walk a fine line — stimulating the economy when necessary, but also maintaining long-term fiscal sustainability.

Conclusion

Fiscal policy is far more than just numbers on a government spreadsheet — it’s a blueprint for how the nation functions. From funding public education to responding to economic crises, from collecting taxes to debating national priorities, fiscal policy affects every American.

Understanding how it works helps us become more informed citizens — and better equipped to participate in discussions about the country’s financial future.

Whether you’re a taxpayer, a student, an investor, or a small business owner, U.S. fiscal policy shapes your world in countless, meaningful ways. And as the economy continues to evolve, so too will the role that government spending and taxation play in our lives.